how long can you short a stock td ameritrade

At TD Ameritrade you can trade forex pairs therefore you can go long or short in any of the currency pairs they offer. Lastly after entering all the above details click the Review Order button.

For example if you borrow 5000 to.

. Typically investors buy stocks they think will go up in price allowing. The goal of the short sale is to profit by anticipating. Placing a short sell on TD Ameritrade is similar to how you would place a standard long trade except you will select Sell short for the action.

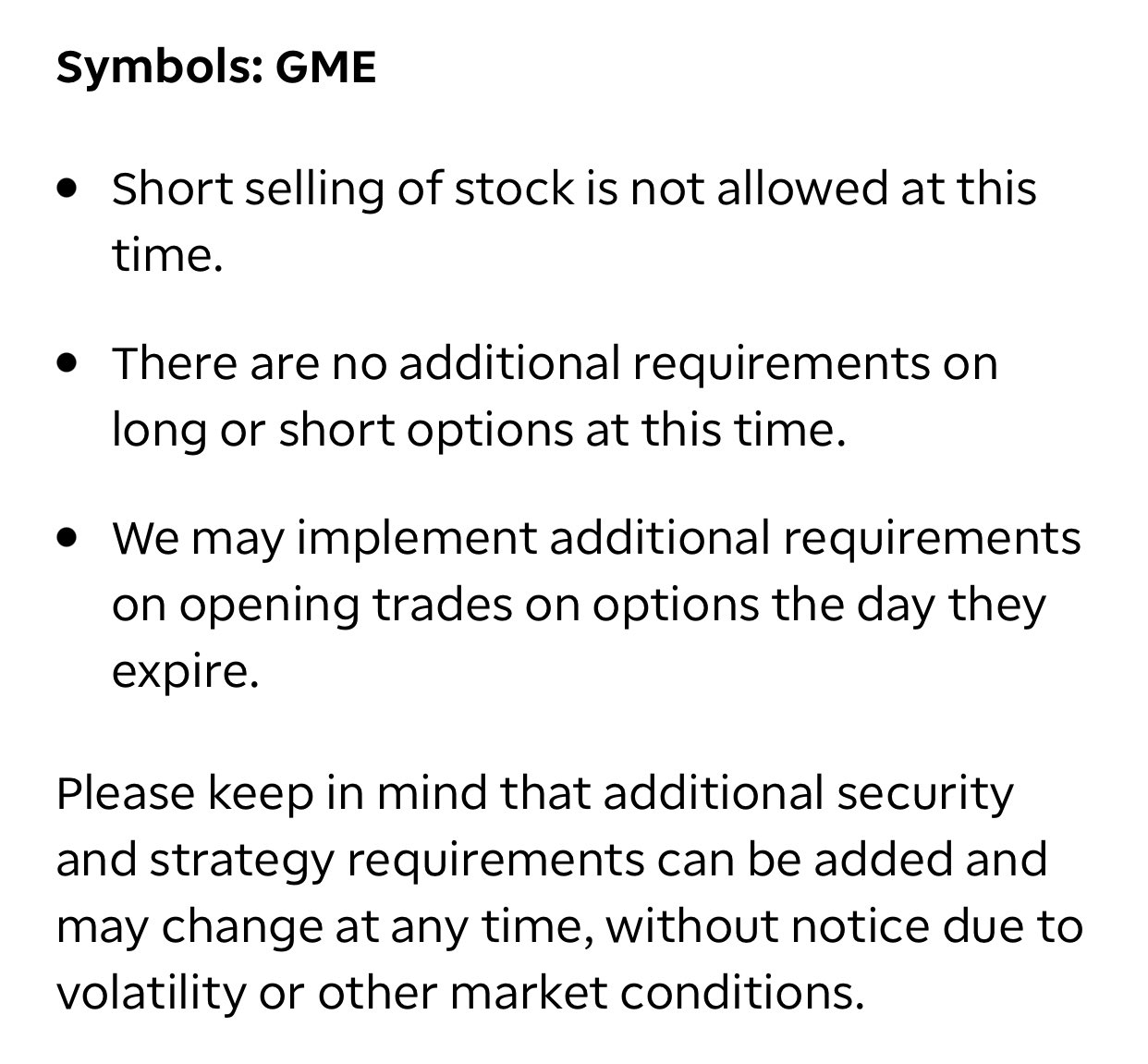

There is no mandated limit to how long a short position may be held. There are no additional requirements on long or short options at this time. On margin account with under 25000 balance you are allowed 3 day trades within 5 trading days period.

The rule puts in a so-called circuit breaker for stock prices restricting short-selling of a stock that has dropped 10 percent or more for the rest of a tra. Short selling of stock is. And all of these assets can be shorted.

In the following table you will find our calculation for shorting the. TD Ameritrade Network is brought to you. Yes you can trade options at TD Ameritrade.

TD Ameritrade Extended-Hours Trading Time and Fees If you have a TD Ameritrade TDA brokerage account you have the ability to trade outside of normal session hours. How to short stock w Td Ameritrade 3 minFacebook. Short selling involves having a.

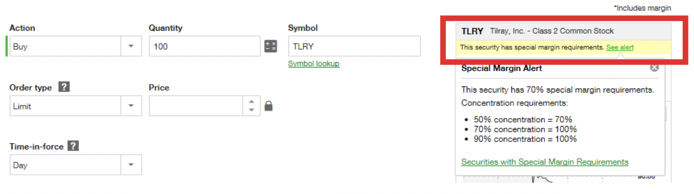

When short selling the risk of loss is potentially unlimited and you may be. Step 7 Submit the Limit Order on TD Ameritrade. The stock you want to sell short must be marginable The stock must be available to borrow.

This will then ask you to review your order to make sure everything. Some riskier types of trades like selling call options on stocks you dont own or writing an uncovered put option can be made only on a margin. Short selling of stock is not allowed at this time.

For example if a stock shorted at 50 is bought back at 40 the seller realizes. 2 days agoThe actual short sale of the stock will be free from commissions but youll still need to pay interest on margin if youre using borrowed funds. A shorted stock or shorting a stock involves selling the borrowed shares and then buying back to close out the short position at a later date.

Short selling on TD. If the price drops the investor can buy back the stock at the lower price and pocket the difference. Updated October 31 2021.

Short selling may be used by experienced investors who seek to generate a profit when the price of a stock goes down.

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

A Beginner S Guide To Td Ameritrade S Thinkorswim Money

5 Best Brokers For Penny Stock Trading 2022 Stockbrokers Com

Free Stock Trading Td Ameritrade

Td Ameritrade Time In Force Day Tif Gtc Ext Good Till Canceled

How To Short A Stock On Td Ameritrade Seven Steps Timothy Sykes

2022 Td Ameritrade Review Pros Cons Benzinga

M B On Twitter As Of January 2022 Td Ameritrade Security Limitations Lists One Stock Restricted From Short Selling Https T Co V9wmoqfoy2 Twitter

Td Ameritrade Login Secure Phone Number Customer Service

How To Short Sell A Stock Td Ameritrade Think Or Swim Youtube

How Can One Short On Td Ameritrade Quora

How To Short A Stock On Td Ameritrade Seven Steps Timothy Sykes

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

How Do I Fix Short Balance I Closed All My Positions To Put In A Roth Ira Can Someone Explain What I Did Wrong How Much Money Do I Owe Td Ameritrade

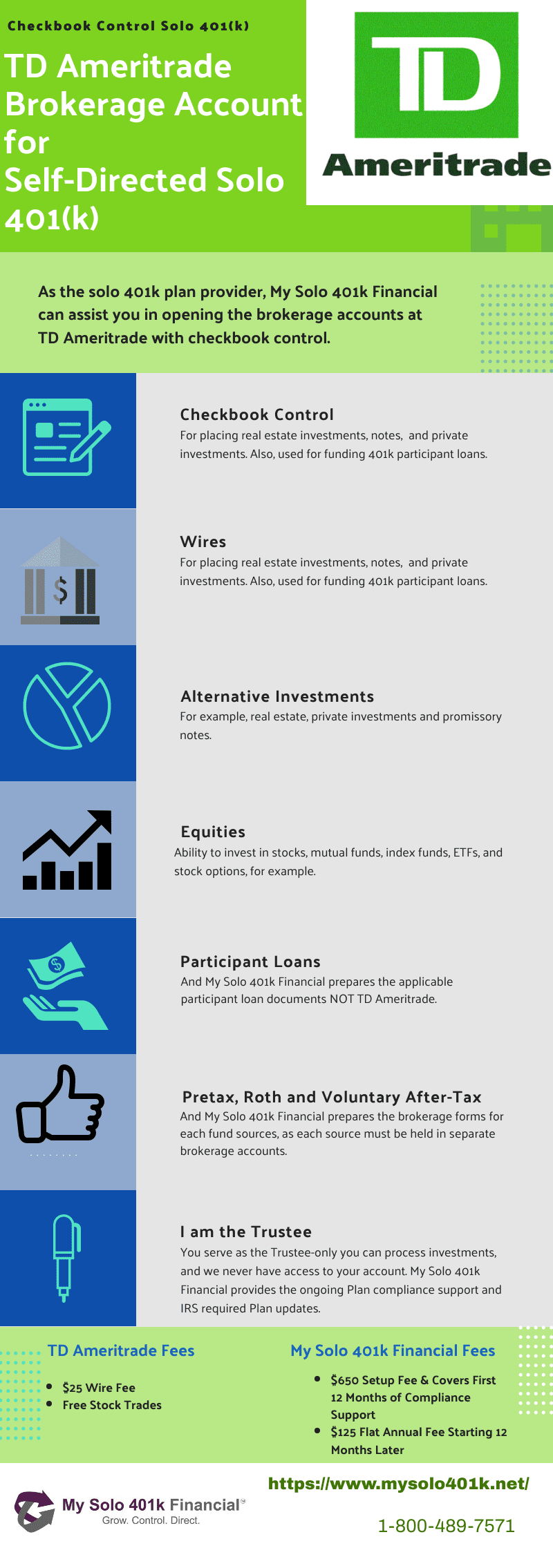

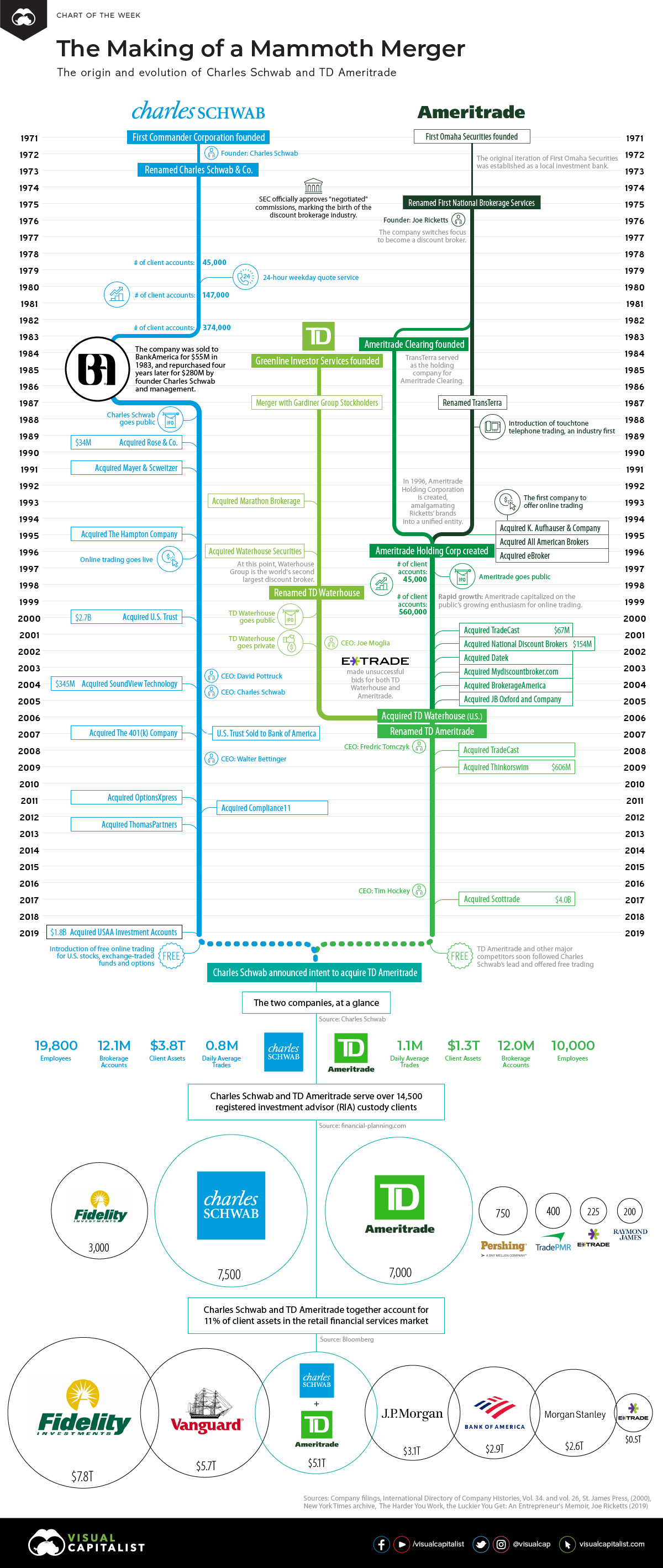

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

:max_bytes(150000):strip_icc()/tradingtech-mobile-download-83f481b767dd4da089ab47fa75a3f6c3.jpg)